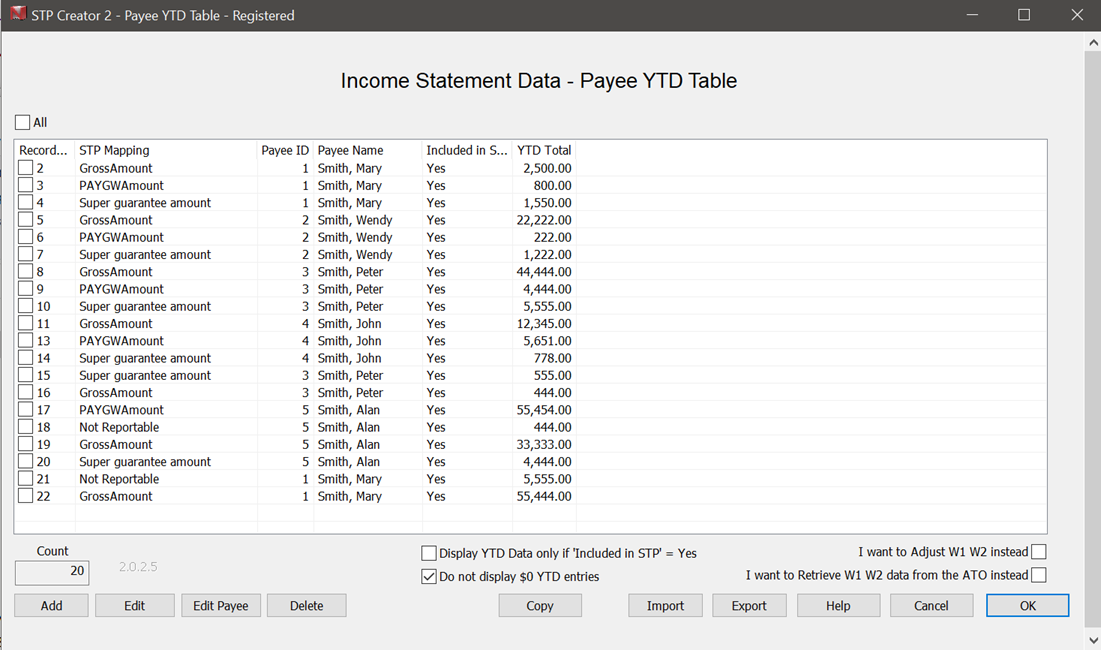

Income Statement Data (YTD) Screen - Other users (non MYOB®)

On this screen, as YTD data is not being extracted from your software, you can either manually add the relevant data or import it from a spread sheet. STP Creator starts by displaying the last known YTD data. You can use this as a starting point and update.

For each Payee you will need a minimum of 3 entries, one for 'GrossAmount', one for 'PAYGWAmount', and one for 'Super guarantee amount'.

Checkboxes

Display YTD Data only if 'Included in STP' = Yes - use this to filter out YTD amounts for Payees excluded form this STP Report.

Do Not display $0 YTD entries - use this to filter out $0 YTD entries

I want to Adjust W1 W2 instead - use this to skip the Load Payroll Data process when you want to use the new Adjust feature for STP Reporting. This allows you to adjust previously reported W1 W2 amounts.

I want to Retrieve W1 W2 data from the ATO instead - use this to skip the Load Payroll Data process when you want to use the new Retrieve Data feature for STP Reporting. This allows you to retrieve reported W1 and W2 amounts over a specified period. Use this in conjunction with the Adjust feature when reconciling W1 W2 figures with your Activity Statements.

Add

Click here to bring up the Add YTD Entry screen. This can be used to individually add a YTD entry. Each Payee will need a minimum of 3 entries, one for Employee gross pay, one for Employee tax, and one for Super guarantee amount.

Edit

Click here to bring up the YTD Editor screen for the selected Record ID(s). This can be used to edit individual YTD amounts as well as display all entries for a specific Payee. This was the original option, however most users will find Edit Payee a better option as it allows you to edit up to 7 YTD records for the selected Payee.

Edit Payee

Click here to bring up the Edit YTD Entries for Selected Payee screen. This can be used to edit all YTD amounts for a specific Payee. Up to 7 entries can be edited. If a Payee has more than 7, use the Edit option for the additional entries.

Delete

Click here to delete the selected YTD entries.

Copy

Copy table to clipboard for pasting to another application. This can be useful to resolve any discrepancy, by sorting and totalling amounts for each Payee.

Import

If not using MYOB®, you can add YTD data for each payee via the Add button or via the Import button. For most users it will be easier to do this via Import. Once you set up and compete your import file, use this same file for subsequent updates, by updating the values after each pay.

Begin by manually adding one entry using the Add button. Then use the Export button to export this entry to a tab delimited file. Open that export file in Excel and add entries for each Payee. Each Payee will need a minimum of 3 entries, one for Employee gross pay, one for Employee tax, and one for Super guarantee amount.

The Export file will include from row 8 all of the available STP Fields you have selected at the STP Fields step. You will also need the Payee ID for each Payee. You can find this on the Payees screen. Copy or export if necessary.

For each entry use a unique Record ID, start with 1, then 2 etc. Copy one of the STP Fields from the cells beginning on row 7 and paste into the Column B of the new entry. Enter the Payee ID in column C and the YTD Total Amount in Column D. Repeat as necessary until all YTD Data for each Payee is added. See this example below (Available STP Fields have been highlighted yellow):

Do not use formatting, such as $ or commas in Column D

Export

Click here to export YTD Data to a tab delimited file. If there is no table data to export, first manually add one or two, then export.

Help

Access on-line Help.

Save

Clicking this button will 'save' or 'accept' this data and return to the Main Screen. Once this screen is saved, and warning free, the word Completed will appear beside the Assemble YTD button on the Main Screen.

Cancel

Close this screen without saving any changes. This will bring you back to the Data Set screen.

Messages

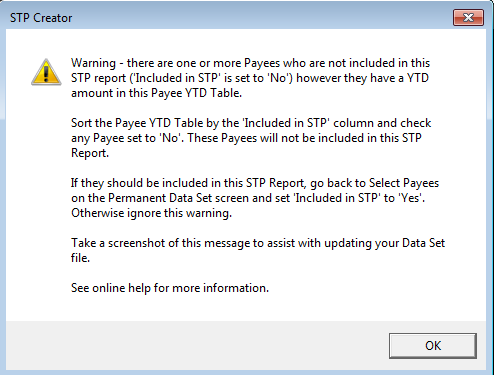

You may see this message when you first open this screen:

This means this Payee YTD table contains Payees who are set to be 'excluded' from this STP Report. The YTD amounts for these Payees will be ignored and not included in the STP Data sent to the ATO. If this YTD data is not required, delete from this table. If the YTD data is required, change this Payee to be Included in STP.

Errors

Importing Errors

'This file cannot be imported as number of fields per line is not 4. Ensure you are using a file originally exported from this screen and updated.'

To import YTD entries, we recommend you ensure there is at least one entry in the table (manually add if necessary), then use the Export button to export YTD entries to a tab-delimited file. This file will have 4 columns. The import file must also have only 4 columns. If you receive this error message, open the file again in excel, highlighted from cell A1 to D1 and down to the last row used, copy and paste into a new spreadsheet. Save this as tab-delimited. Try to import again. This should ensure any extra cells are not included in the import file.

'No Payee data imported. See Help for assistance'

This error usually occurs if the Record ID field cannot be converted to a number. If unable to resolve import errors, email a copy of the spreadsheet to sales@namich.com.au so we can examine and advise.