Payee Details

(Note: The information provided below is based on ATO documentation and is current at the time of preparation. It is however general in nature and provided for assistance only. Should you require further information or clarification of what to show in any field, consult your accountant or the ATO).

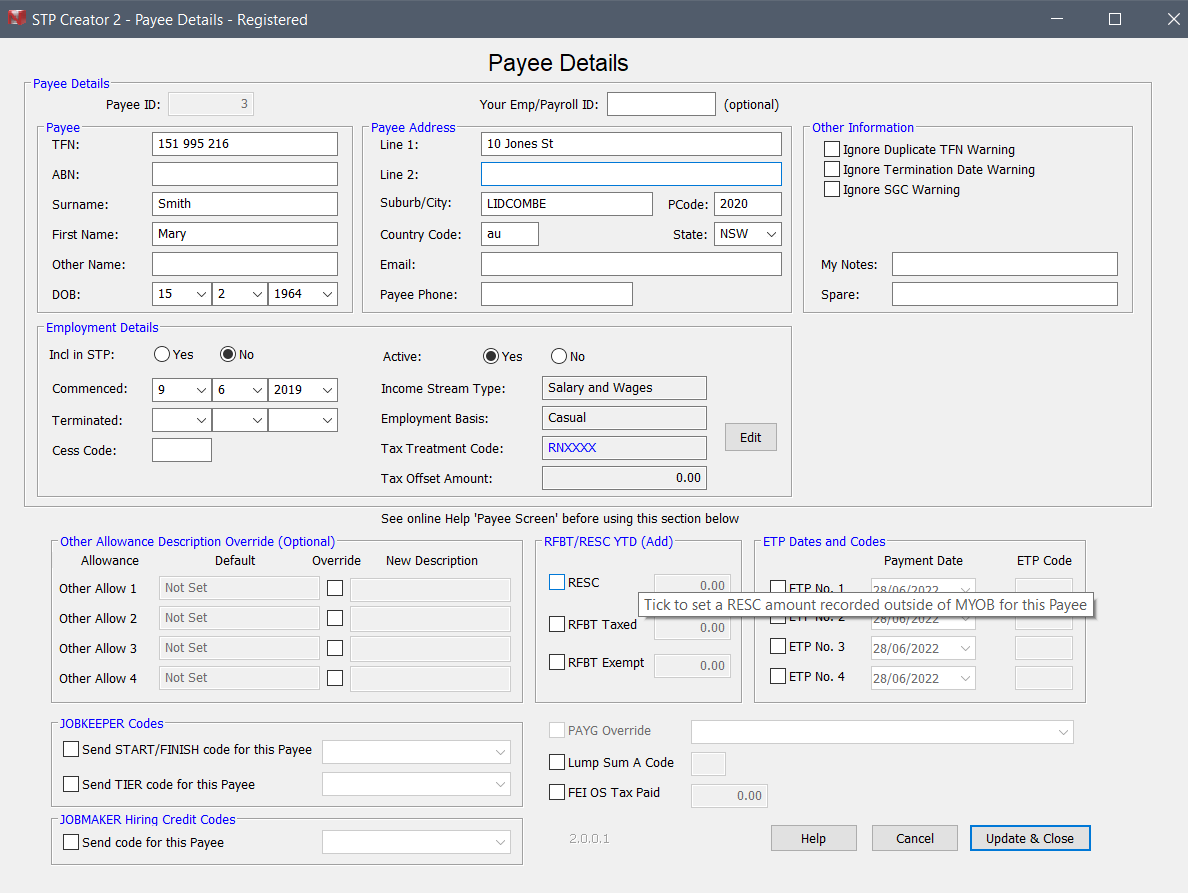

The Payee Details screen can be located from Permanent Data Set screen > Select Payees > Edit.

This screen shows the existing data for the selected Payee including the transactions selected for inclusion in the Report.

Payee Details

Payee

Payee ID:

This field is for internal purposes. STP Creator uses this ID to identify each Payee for displaying Payee details, transactions etc as well as for sorting. For an existing Payee this Field is non-editable. When adding a new Payee, we recommend you accept the default Payee ID provided. You may however choose your own number for this Payee provided that number is less than 9 digits and not used by any other Payee.

Use the Your Payee Ref No: field for any reference you use to identify this Payee.

Your Payee Ref No:

This is an optional field. Enter any reference you use to identify this Payee here. Accepts alpha - numeric characters.

TFN

Payee TFN must be a valid 9 digit TFN, entered without spaces. Any spaces will be removed from final data transmitted. See TFN Codes at end of this page for TFN's to use when a valid TFN is not provided.

ABN

Payee ABN must be a valid 11 digit ABN, entered without spaces. Any spaces will be removed from final data transmitted. An ABN must be provided where reporting Voluntary Withholding for a Payee,

A TFN or an ABN is compulsory.

Surname

Must be included. Mr, Mrs etc should not be included. Must be blank for Entity. Do not include full stops, commas etc.

First Name

Must be included. Mr, Mrs etc should not be included. Do not include full stops, commas etc.

Other Name

Include individual's second given name here. If you only know the initial of the second given name, include that here. Leave blank if Payee does not have a second given name. Do not include full stops, commas etc.

Date of Birth (DOB)

Compulsory field. Select Day, Month and Year from the respective fields. Must be a valid date. Payee date of birth (Payee Day of Birth, Payee Month of Birth, Payee Year of Birth) may not be a date in the future or more than 120 years in the past.

Payee Address

Address Line 1 and Address Line 2

Lines 1 and 2 must only contain the Payee's street or postal address (excluding suburb, town or locality, state, postcode and country). It is not necessary to use both lines. These fields accept alpha numeric characters only. Do not include full stops, commas etc. The second line can be left blank.

Suburb/City

This field must contain the suburb, town or locality for the address of the Payee. This field accepts alpha numeric characters only.

If reporting an overseas address, all data except country code must be in Address Line 1, Address Line 2 and Suburb/City - PCode and State must be blank.

State

This field must contain the state or territory for the address of the Payee. Must be AAT, ACT, NSW, NT, QLD, SA, TAS, VIC or WA. Leave blank for overseas address.

PCode

This field must contain the postcode for the address of the Payee. This field accepts numeric characters only. For 3 digit postcodes, use a leading zero, for example 0800. Leave blank for overseas address.

Country

If country is Australia, this field can be left blank or use AU. For other countries, use the relevant 2 digit country code, available from the ATO.

The email address for the Payee if available.

Payee Phone

The telephone number for the Payee if available. A phone number entered in this field must have 10 digits. This can be either the area code followed by the telephone number for example 0212345678, or mobile phone number for example 0466123456. Do not include spaces, dashes or brackets.

Other Payee Information

Ignore Duplicate TFN Warning

If this Payee uses a TFN that is also used by another Payee, You will receive a Warning message at Step 6. If there is a valid reason for the use of a duplicate TFN, such as you have 2 Payee ID's for the same Payee (one as a Working Holiday Maker and one as an Aust resident) or this is one of several Payees using a TFN Code such as 333 333 333, to avoid this Warning message, tick this check box on all affected Payees

Ignore Termination Date Warning

If this Payee has a Termination Date outside of the current STP Report period, you will receive a Warning message at Step 6. If there is a valid reason for including this Payee with a Termination date, for example the Payee has left however you want to keep reporting this Payee until the end of this Payroll year, to avoid this Warning message, tick this check box for the affected Payee.

Ignore SGC Warning

If this Payee has a low amount for Super Guarantee contributions, you will receive a Warning message at Step 6, as this could be a sign of incorrect mapping. If there is a valid reason for the low Super guarantee amount, such as the employee is under 18 or over the contribution age, to avoid this Warning message, tick this check box for the affected Payee.

My Notes

Record any notes for yourself or other users. This data does not go to the ATO and is purely for your reference.

Spare

Record any notes for yourself or other users. This data does not go to the ATO and is purely for your reference.

Employment Details

Inc in STP

Select Yes to include this Payee in STP Reports or No to exclude. Do not include employees who have left before this Payroll Year.

Commenced

Select Day, Month and Year from the respective fields. Must be a valid date.

The commencement date must be reported, if commencement date is not known, report 01/01/1800.

If the commencement date is earlier than 01/01/1950, then report 01/01/1950.

The commencement date must reflect the earliest recognised start date for the continuous employment/engagement period of service with the Payer or related entity.

If the Payee is rehired using the same payroll id the rehire commencement date should be reported.

- If the Payee was terminated and rehired in the same reporting period, using the same payroll Id, the rehire commencement date should not be reported.

- If the Payee was terminated and rehired under a different related entity ABN /branch in the same reporting period, the rehire commencement date does not have to be reported. The earliest recognised start date for the continuous employment/engagement period of service should continue to be reported.

Terminated

Select Day, Month and Year from the respective fields. Termination Date must be provided and must be a valid date and must be within the current Payroll Year.

If there is a Termination Date that falls inside the current Payroll Year, this will be included in the transmitted data. If the Termination Date falls outside the current pay period, you will receive a Warning Message when you click Assemble Final STP Report Data. If the employee has been terminated in a prior pay period, you should Finalise this employee and remove them from subsequent STP reports. Have a look at Report for a Payee who has ceased for more information.

You cannot include a Payee who was terminated in a prior year. If making a payment to an employee terminated in a prior year, set termination date to 1 July in the current payroll year.

A Cessation Code must also be provided.

Cessation Code

If a Termination Date exists, a Cessation Code must be provided. See Cessation Code for valid options.

Active

Selected Yes or No for the employee status. Simply provides an additional field for selecting Payees from the Payees screen.

Income Stream Type

This is a read-only field and shows the Income Stream Type that will be reported for this Payee. To edit, click the Edit button. This will open the Employment Details Editor.

Employment Basis

This is a read-only field and shows the Employment Basis that will be reported for this Payee. To edit, click the Edit button. This will open the Employment Details Editor.

Tax Treatment Code

This is a read-only field and shows the 6 character Tax Treatment Code that will be reported for this Payee. To edit, click the Edit button. This will open the Employment Details Editor.

Tax Offset Amount

This is a read-only field and shows the Tax Offset Amount that will be reported for this Payee. To edit, click the Edit button. This will open the Employment Details Editor.

Allowance Other Override (Optional)

See Handle Allowances for additional information about Allowances.

The ATO provides 8 preset allowance types: Car (Cents per km), Award Transport, Laundry, Meal, Travel, Tool, Task and Qualification.

STP Creator allows you to use 4 more Allowances, Allowance Other 1, 2, 3 and 4. When you select these additional Allowances in the STP Fields Table, you can set the Description for each one - see Handle Allowances. If these 12 Allowances are not enough for your purposes, you can add more Allowances by overriding each of these Allowances Other on a per Payee Basis.

In the example under Handle Allowances, 'Allowance Other 1' is set to U1 for Uniform related allowances. This is what STP Creator will use for any Payroll Category mapped to 'Allowance Other 1', unless the Payee concerned has an 'Allowance Other 1' override in place. When 'Allowance Other 1' is checked on a Payee Details screen, any Payroll Category mapped to 'Allowance Other 1', will use the Description set on the Payee Detail screen for that Payee.

In the Example under Handle Allowances, the Payroll Categories mapped to 'Allowance Other 1' use the description 'OS Accommodation', as you can see on the Final STP Report Data screen extract.

Other Allow 1

Tick this checkbox to override the current default Allowance Other 1 Description set on the STP Fields Tables with a description of your choice based on ATO recommendations here. Enter description in adjacent field. Alpha Numeric characters only.

Other Allow 2

Tick this checkbox to override the current default Allowance Other 2 Description set on the STP Fields Tables with a description of your choice based on ATO recommendations here. Enter description in adjacent field. Alpha Numeric characters only.

Other Allow 3

Tick this checkbox to override the current default Allowance Other 3 Description set on the STP Fields Tables with a description of your choice based on ATO recommendations here. Enter description in adjacent field. Alpha Numeric characters only.

Other Allow 4

Tick this checkbox to override the current default Allowance Other 4 Description set on the STP Fields Tables with a description of your choice based on ATO recommendations here. Enter description in adjacent field. Alpha Numeric characters only.

Errors - If a checkbox was ticked and a description entered, unticking the checkbox without clearing the description will cause an error. The description field must be empty. To clear an error, tick the checkbox to enable the description field, clear the description and then untick the Check Box.

RFBT/RESC YTD (Add)

The general rule with STP is once you report an amount, you must keep reporting it.

Say on an earlier STP you reported an RESC amount of $1200. Subsequent report should also include this $1200 RESC, unless the earlier report was incorrect. To continue to report the $1200 RESC, tick the RESC check box and enter $1200.00 in the amount field. In subsequent STP Reports.

We recommend NOT reporting RESC or RFBT until the very end of the year when finalising your Payment Summaries (or Income Statements). Update these fields on the Payee Details screen of each affected Payee. When assembling the YTD Data STP Creator will used these amounts.

RESC

Tick this checkbox to enter a RESC amount for STP Creator.

RFBT Taxed

Tick this checkbox to enter a RFBT Taxed amount for STP Creator.

RFBT Exempt

Tick this checkbox to enter a RFBT Exempt amount for STP Creator.

Errors - If a checkbox was ticked and an amount was entered, unticking the checkbox without setting the amount back to 0.00 will cause an error. The amount field must show 0.00. To clear an error, tick the checkbox to enable the amount field, set to 0.00 and then untick the Check Box.

ETP Dates and Codes

See ATO's Taxation of Termination Payments here and ETP Codes here

STP Creator allows you to report up to 4 separate ETP Payments for each Payee. Store the ETP Code and Payment Date for any Eligible Termination Payments being reported.

If more than one ETP is paid to the same Payee, the ETP's are not to be combined, you must report each one separately.

ETP No. 1

Tick this checkbox to select a Payment Date and enter an ETP Code for the 1st ETP. These details will be used by STP Creator for any YTD amounts allocated to ETP 1 STP Field.

ETP No. 2

Tick this checkbox to select a Payment Date and enter an ETP Code for the 2nd ETP. These details will be used by STP Creator for any YTD amounts allocated to ETP 2 STP Field.

ETP No. 3

Tick this checkbox to select a Payment Date and enter an ETP Code for the 3rd ETP. These details will be used by STP Creator for any YTD amounts allocated to ETP 3 STP Field.

ETP No. 4

Tick this checkbox to select a Payment Date and enter an ETP Code for the 4th ETP. These details will be used by STP Creator for any YTD amounts allocated to ETP 4 STP Field.

Errors - If a checkbox was ticked and an ETP Code was entered, unticking the checkbox without clearing the ETP Code will cause an error. The ETP Code field must be empty. To clear an error, tick the checkbox to enable the ETP Code field, clear the code and then untick the Check Box. The Date field will be ignored if the checkbox is unticked.

While you can have 2 or more ETP's with the same Payment Date, they cannot also have the same ETP Code.

JOBKEEPER Codes

See JobKeeper for more information about these settings.

START/FINISH code

If you need to send a new JobKeeper START or FINISH code for this Payee, tick the checkbox and select a code from the drop down list. If the code you need to send is not in the drop down list, manually enter the code. Ensure format matches codes in drop down list.

Note: Once a JobKeeper code has been sent, the code should be removed from the Data Set file. Return to this screen after you lodge this STP Report and remove this tick.

TIER code

If you need to send a new JobKeeper TIER code for this Payee, tick the checkbox and select a code from the drop down list.

Note: Once a JobKeeper code has been sent, the code should be removed from the Data Set file. Return to this screen after you lodge this STP Report and remove this tick.

JOBMAKER Codes

See JobMaker for more information about these settings.

PAYG Override (Discontinued - replaced with Income Stream Type codes)

PAYG Override

Tick this checkbox to select an alternative STP Field for mapping PAYG Withholding for this Payee.

Lump Sum A Code (Discontinued - Replaced with Lump Sum A Type R and Lump Sum A Type T)

While MYOB® can record payment for Lump Sum A, it cannot store the Lump Sum A code. This can be stored here.

Lump Sum A code

Tick this checkbox to enter a Code (R or T).

Errors - If a checkbox was ticked and a Code was entered, unticking the checkbox without clearing the Code will cause an error. The Code field must be empty. To clear an error, tick the checkbox to enable the Code field, clear the code and then untick the Check Box.

Update & Close

Pressing here will update all the Payee fields, close this screen, and record the Checked field as 'Yes'. An edit check will be performed for data validity including compulsory fields. If you do not press Update & Close, any modified Payee Data will not be changed.

Help

Access on-line Help.

Cancel

Close this screen without saving any changes.

TFN code |

Description |

000000000 |

No TFN quoted by the payee – the payee chooses not to quote a TFN or fails to provide one within 14 days. |

111111111 |

Payee applying for a TFN – if a declaration is received from a payee who does not provide a TFN but indicates on the TFN declaration that one has been applied for, an interim code of 111111111 can be used by the payer. This code would usually be updated with the payee’s TFN or with the no TFN quoted code [000000000] where the payee fails to provide the TFN to the payer within the 28 day period allowed. |

333333333 |

Payee under eighteen – where the payee is under the age of eighteen and claims the general exemption and does not earn enough for tax to be deducted, they may claim an exemption from quoting a TFN. In this case the code 333333333 must be used. N.B.If circumstances change and the payee subsequently earns a level of income that attracts tax, a TFN will be required to be provided at that time. |

444444444 |

Payee is a pensioner – where the payee is a recipient of a social security or service pension or benefit (other than Newstart, sickness allowance, special benefits or partner allowance) an exemption from quoting a TFN may be claimed. In this case the code 444444444 must be used. |