Allowances Phase 2

See introduction to Phase 2 Allowances here

See ATO's Employers Guide for Allowances here

See ATO's Common Questions and Mistakes - Allowance here

How to Report Allowances in STP Creator

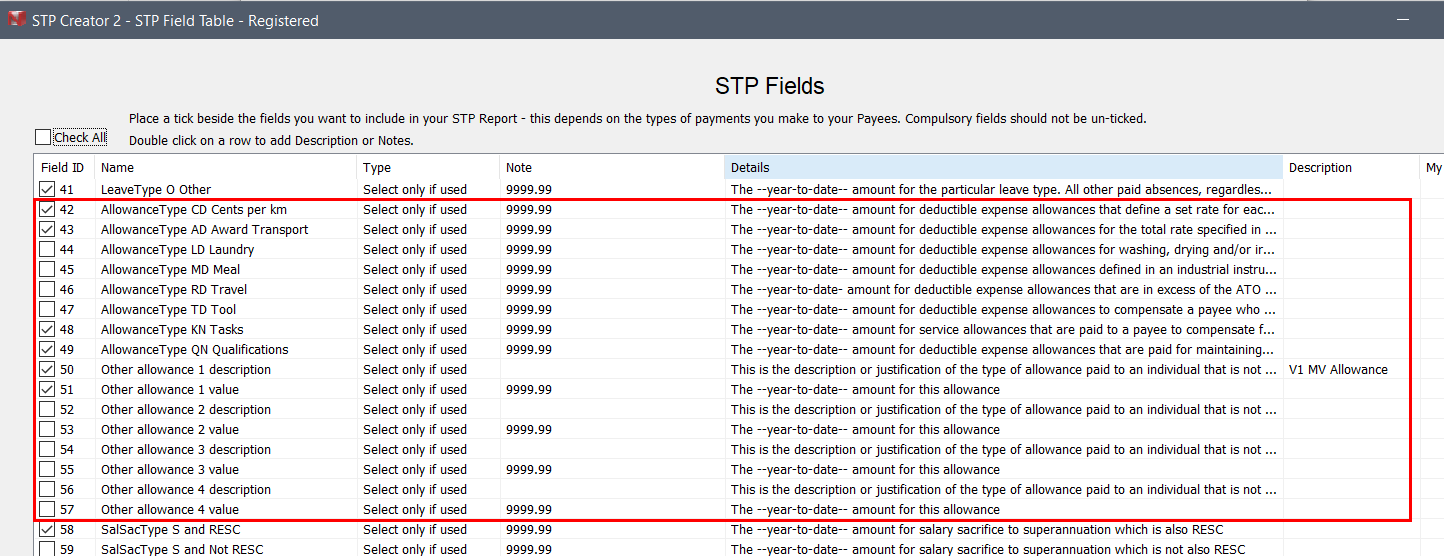

The ATO provides 8 preset allowance types:

- CD Cents per km

- AD Award Transport

- LD Laundry

- MD Meal

- RD Travel

- TD Tool

- KN Tasks

- QN Qualifications.

There is a STP Field for each of these (Field ID 42 to 49). If you want to use one or more of these allowances, select the relevant Field ID in the STP Fields table as illustrated below. Once selected, that allowance will be available when mapping Payroll Categories.

In addition to these 8 preset allowances, STP Creator allows you to set up to 4 Other Allowances to suit your needs (Field ID 50 to 57). These fields come in pairs, one field holds the Allowance Description while the other holds the value. When you select to use these additional Other Allowances in the STP Fields Table, you must set the Description for each one.

See Allowance Phase 2 for more detail about how to code Other Allowances.

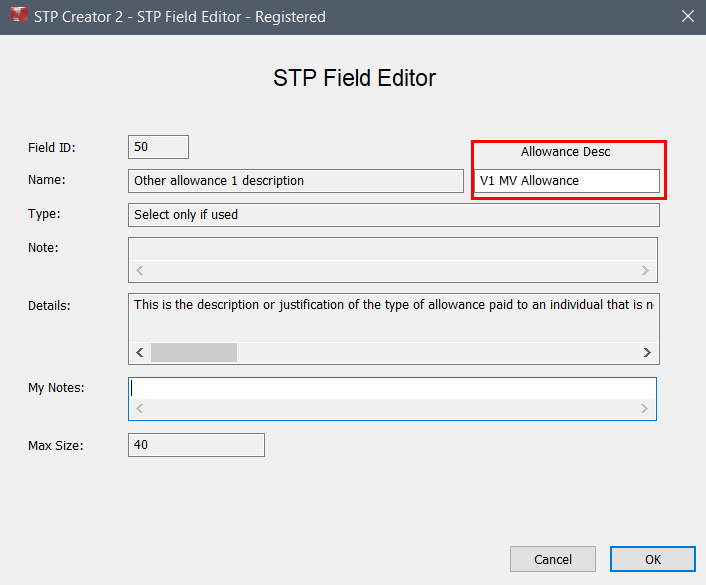

For example if you wanted to use Other Allowance 1 as a Car Allowance based on a weekly rate, select Field ID 50 and 51. Double click on Field ID 50 - this allows you to set the Description to Uniform as per image below.

Each Description you set in the STP Fields table becomes the default Description for this Other Allowance for all employees. This means you can have up to 13 Allowances for all of your employees. When set as per above, Other Allowance 1 Description will show as V1 MV Allowance Final STP Report Data Screen. This STP Field will be used for any Payroll Category mapped to this STP Field, unless an override is in place for the Payee.

Overriding Other Allowance

If these 12 Allowances are not enough for your purposes, you can add more Allowances by overriding each of these 4 Other Allowances on a per Payee basis.

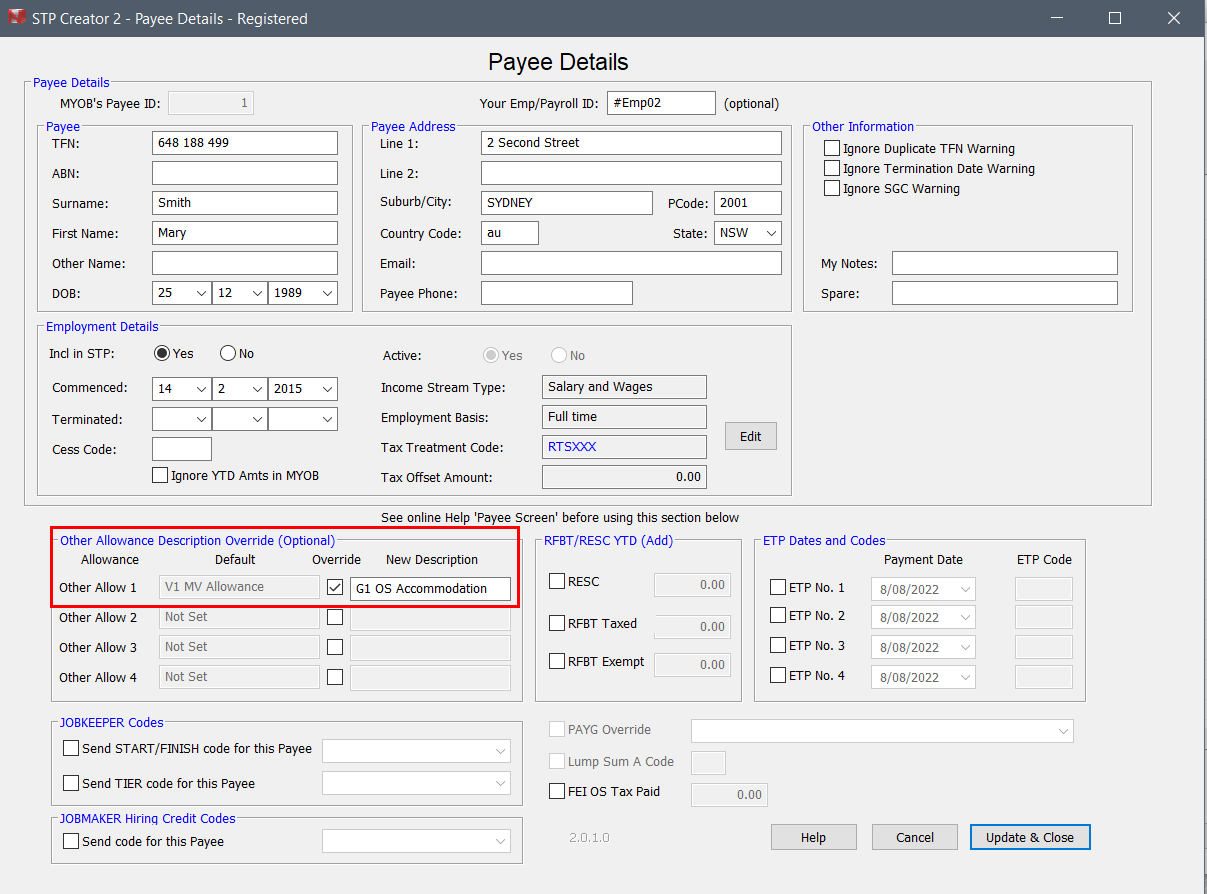

In the example above 'Other Allowance 1' Description is set to V1 MV Allowance. This is what STP Creator will use for any Payroll Category mapped to 'Other Allowance 1', unless the Payee concerned has an 'Other Allowance 1' override in place. When 'Other Allowance 1' is checked on a Payee Details screen under Other Allowance Description Override, any Payroll Category mapped to 'Allowance Other 1', will use the Description set on the Payee Detail screen for that Payee.

For example say you have set all of the 4 Other Allowance Descriptions to your 4 most common allowances. One employee however receives a less common Allowance - OS Accommodation. If this employee does not receive a MV Allowance, you can override the default Other Allowance 1 Description for this employee on the Payee Details screen (Permanent Data Set screen > Select Payees > Edit). See example below:

Map the Payroll Category you use for OS Accommodation allowance payments to Other Allowance 1 Value. On the Final STP Report Data Screen (Step 6) the Description used for this employee for Other Allowance 1 will be 'G1 OS Accommodation' while all other employees with show 'V1 MV Allowance'.

Notice on the extract from the Final STP Report Data screen below that while for all other Payees, 'Other allowance 1 description' is set to V1 MV Allowance, for this Payee (highlighted) the allowance description is set to 'G1 OS Accommodation', due to the override on the Payee Details screen for this Payee.

Note that if the value for an Allowance is 0.00, nothing is reported for this Allowance.