JobKeeper - MYOB® Users - Notifying the ATO which employees are Eligible and Reporting TopUp Payments

Note - you must install and use STP Creator v1.0.5.8 or later in order to notify the ATO of JOBKEEPER eligibility and/or TIER codes

NOTE 1:

This Help Article is designed to assist you to NOTIFY the ATO of eligible employees via STP and how to Report JobKeeper TopUp payments. This Help Article should be read in conjunction with the ATO's guide for employers - see link to ATO guide under JobKeeper - The Basics. ATO documentation should be your primary reference for JobKeeper Payments.

Please consult the ATO and or your tax adviser for specifics about eligibility and when and how things need to be notified, reported and confirmed. This includes how to APPLY for JobKeeper payments, how to NOTIFY the ATO who is eligible, and how to confirm eligible employees have been paid each month to trigger the ATO Reimbursement process and provide other supporting information.

Once you understand what you need to do, for example:

- advise the ATO an employee is eligible for JobKeeper from a JobKeeper Fortnight and Tier level

- advise the ATO an employee is no longer eligible from a certain JobKeeper Fortnight

- report a JobKeeper TOPUP payment for an employee

- correct a JobKeeper START/FINISH or TIER code sent in error

the information below will show you how to do it.

NOTE 2:

If you are a Quarterly Reporter and lodge STP Reports after the end of the Quarter, DO NOT use STP Creator to NOTIFY of eligibility. Eligibility must be notified on a monthly basis, for example eligibility for April 2020 must be notified no later than by 31 May 2020. If you NOTIFY in July 2020, it will be too late to claim for April and May 2020. Use the Business Portal to NOTIFY Eligible Employees, not STP Creator.

NOTE 3:

STP Creator has been updated to provide a more efficient way to send JobKeeper START/FINISH and TIER codes to the ATO. You no longer need to set a Description for an Other Allowance field, all settings are made on the Payee Details screen. We are also recommending you send a JobKeeper START/FINISH and TIER code once per payee and then remove the code from your Data Set file. If circumstances change or you made an error, you can send a new code - see JobKeeper - Changes and Corrections.

Before proceeding, we recommend you remove any JOBKEEPER-START-FNxx code from any Other Allowance Description and remove any Other Allowance Override set on the Payee Details screen of any employee. See JobKeeper - Removing Codes for further information.

NOTE 4:

JobKeeper START/FINISH and TIER codes need only be sent once to the ATO. Once a code is sent, it is retained by the ATO until it is replaced with a new code. For JobKeeper Extension, what this means is that if you have sent a JOBKEEPER-START-FNxx code for an employee, the ATO will continue to use that code. There is no need to send another JOBKEEPER-START-FNxx code if you are continuing under JobKeeper Extension. You do however need to send a TIER code for each employee you are claiming for. This will notify the ATO which rate to pay.

JobKeeper Fortnights

See this link JobKeeper Fortnight which shows the JobKeeper Fortnightly periods and START/FINISH Codes, including for JobKeeper Extension. An employer is not required to change their pay cycle or payment dates. If your paydate falls in a particular JobKeeper Fortnight, then this is the Fortnight you use. For example if your regular fortnightly payment date is 7 Oct 2020, then this is a Fortnight 14 payment.

START CODE

Employers are to notify eligibility based on a Start code. If an employee is eligible from Fortnight 01, the Start code should be reported as JOBKEEPER-START-FN01

FINISH CODE

If an employee ceases to be eligible before the Subsidy period ends, Employers are to notify a Finish code. If an employee is in-eligible from Fortnight 05, the Finish code should be reported as JOBKEEPER-FINISH-FN05. You will not receive a subsidy for Fortnight 05.

Using STP Creator to Notify Eligibility and Report - MYOB® users

Note: This Help Article outlines how to report JobKeeper TopUp payments and how to NOTIFY eligibility START and FINISH codes and TIER code using STP Creator. We are not authorised to provide advice on whether you need to make a JobKeeper TopUp payment, nor how much you need to pay as a JobKeeper TopUp payment, nor which START or FINISH Fortnight or TIER you should NOTIFY. You should check these things with the ATO or your Tax Adviser if in doubt.

Using STP Creator

For each eligible employee you need to NOTIFY the ATO up to 4 things via STP:

- JOBKEEPER start fortnight in the form JOBKEEPER-START-FNxx

- JOBKEEPER top up amounts in the form JOBKEEPER-TOPUP and the YTD amount

- JOBKEEPER end fortnight in the form JOBKEEPER-FINISH-FNxx

- JOBKEEPER TIER in the form JK-TIER1 or JK-TIER2

As a minimum. for each eligible employee you will need to NOTIFY their JOBKEEPER START fortnight and TIER code.

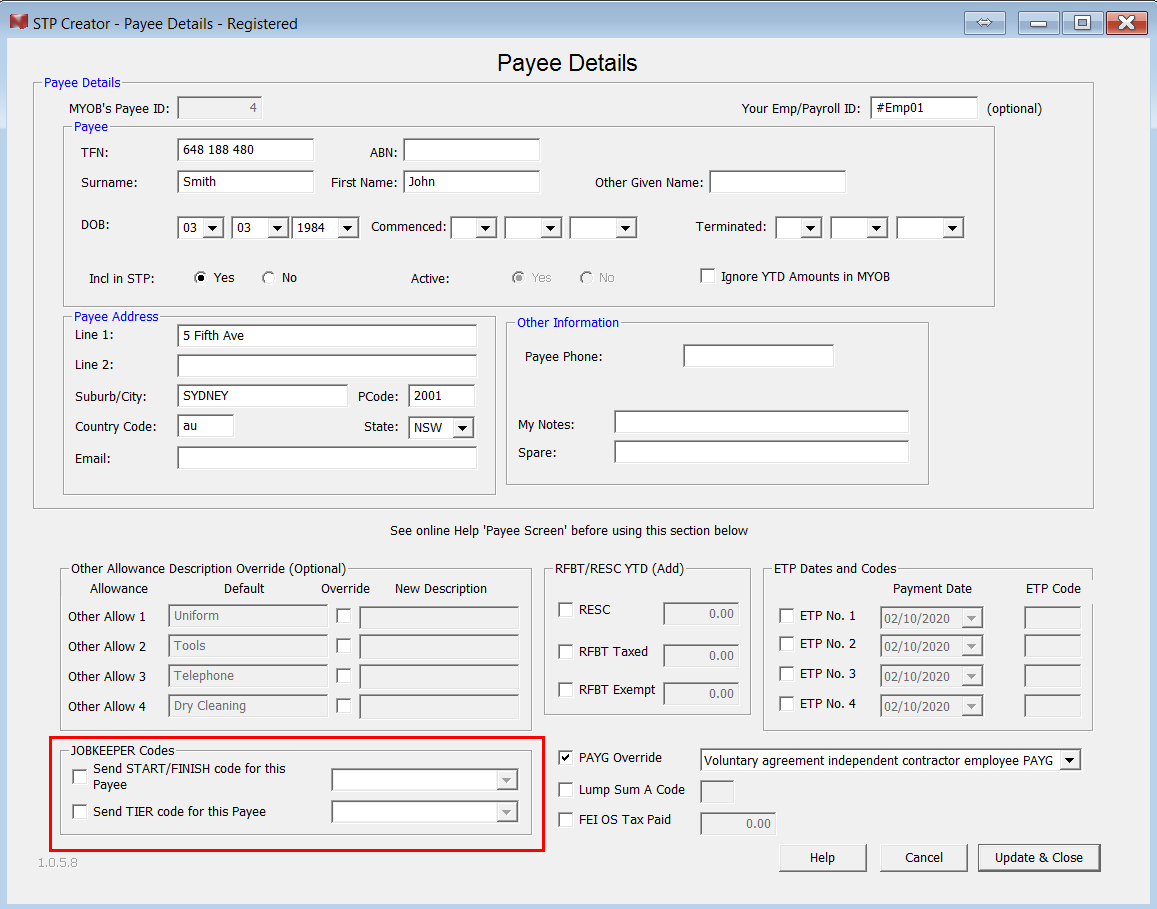

JobKeeper START/FINISH and TIER codes are set on an employee's Payee Details screen in the section highlighted below:

The Payee Details screen can be located from Permanent Data Set screen > Select Payees > Edit.

JOBKEEPER START

If you have already sent a START code for this employee, you do not need to re-send. Only send a START code for an employee who is new to JobKeeper or if they again become eligible.

For example if an employee commences to be eligible from Fortnight 15 tick the check box beside 'Send START/FINISH code for this Payee' and select

'JOBKEEPER-START-FN15' from the drop down list.

If you need to send a code that is not on the list, manually enter the code, ensuring format is identical to those in the list, for example 'JOBKEEPER-START-FN08'.

JOBKEEPER FINISH

Where you have an eligible employee who ceases to be eligible before the end of the JobKeeper Extension period, you will need to report their JOBKEEPER FINISH fortnight. Tick the check box beside 'Send START/FINISH code for this Payee' and select a FINISH code from the drop down list.

For example if an employee is in-eligible from Fortnight 18, the select JOBKEEPER-FINISH-FN18 from the drop down list. You will not receive a subsidy for Fortnight 18.

If you need to send a code that is not on the list, manually enter the code, ensuring format is identical to those in the list, for example 'JOBKEEPER-FINISH-FN08'.

JOBKEEPER TIER

For JobKeeper Extension, you must advise the ATO what TIER code applies for each eligible employee. The TIER code is based on hours worked during a reference period. See the ATO website about which reference period to use.

JobKeeper TIER Code

Tier 1 - for those working 80 hours or more in any reference period; and

Tier 2 - for those working fewer than 80 hours in any reference period

Once you have determined the relevant Tier for an employee, to send this TIER Code to the ATO, tick the check box beside 'Send TIER code for this Payee' and select the TIER code JK-TIER1 or JK-TIER2 from the drop down list.

You only need to send the code once. If you made an error you can correct it by sending the correct TIER code in a subsequent STP Report.

Recommended Procedure

- Set the code(s) you wish to send on the employee's Payee Details screen then click Update & Close to save the setting. Complete steps 2, 3 and 4 as per usual.

- On the Final STP Report Data screen (Step 4) carefully review this Payee's 'Other Allowance' columns to ensure the code(s) are correctly shown.

- Lodge the STP Report.

- Once successfully lodged click 'Copy Table' then paste into a spreadsheet. Save spreadsheet as your record of the codes sent.

- Return to the employee's Payee Details screen and remove any ticks in the JOBKEEPER Codes section.

JOBKEEPER TOPUP

If you are required to report TopUP payments, see Reporting TopUP Payments for how to setup and report TopUp Payments through STP Creator.

JOBKEEPER Changes and Corrections

Once a code is sent, it is retained by the ATO until it is replaced with a new valid code. If an employer sends the same code again, this is ignored by the ATO. Sending no code or N/A for example does not replace the code currently stored by the ATO as these are not valid codes.

To correct a code sent in error, please follow the examples at JobKeeper - Changes and Corrections.

Historical Reports in Single Touch Portal

When reviewing historical reports under Entities > History, the Single Touch Portal will display JOBKEEPER notifications and amounts as per the image below.

Extra Assistance Required

As with any STP Creator issues, if you are having difficulty resolving, send us an email with the details (including screenshots). We will provide guidance via email as soon as we can. Alternatively if you would like someone to connect remotely to resolve the issue, we have a HelpMe! service - see link under Extras on our Purchase Page here - a fee applies.