Eligible Termination Payments

FROM:

SINGLE TOUCH PAYROLL ‘PAYROLL REPORTING’ BUSINESS IMPLEMENTATION GUIDE (SINGLE TOUCH PAYROLL BIG)

PAGE 23

3.1.7 Employment termination payments (grouped by ETP payment date and ETP code)

The business rules for ETPs are:

1. An ETP is required to be reported in a pay event, on or before the day payment is made to the employee.

2. If the payment is not made on the regular pay cycle payment date the employer may choose to treat the payment as an out of cycle payment and defer the reporting to the next regular pay cycle payment date.

3. Where an employee receives more than one ETP payment and type, each combination of ETP payment date and code should be reported separately within the employee record.

The business rules for Lump Sum A and B payments are:

1. Where an employer makes multiple lump sum A and B payments for different income sources e.g. Individual Non-Business (INB) and Foreign Employment Income (FEI) a single YTD figure should be reported.

2. Where an employer makes multiple lump sum A payments and the code changes between payments the employer should report the code relating to the latest payment.

For Business rules on lump sum D see 3.3.5

3.1.8 ETP death benefits

The business rules for ETP death benefits are:

1. Where an employer pays a death benefit it may be voluntarily reported through STP.

2. When paid to an individual beneficiary (dependant or non-dependant) use the beneficiary TFN (if provided).

3. When paid to a trustee use the TFN for the estate (if provided).

4. Where there has been more than one payment made follow the same rules as multiple ETP payments.

5. If there are no further payments expected to be made to a beneficiary or the trustee, mark the record as final.

You may need to finalise STP reporting for the deceased employee in a later pay event or via an update event. Refer to section 3.3.1 Finalisation during the financial year

To capture a TFN, employers should use existing processes.

For clarity, the final pay owing to the deceased employee up to their date of death is not an ETP, it is salary and wages. Final pay is neither taxable, nor reportable and should not be reported in the pay event.

How to record ETPs in STP Creator (MYOB® Users)

Step 1

Follow MYOB Support Notes for how to record the ETP in MYOB®. Do not use the normal PAYG for Tax Withheld (as tax withheld on a ETP must be reported separately), create a new Deduction Payroll Category for the Tax Withheld component.

Step 2

From the Permanent Data Set screen click 'Select STP Fields' then tick Field ID 72 to include ETP Fields in your STP Report (as per image below)

Step 3

From the Permanent Data Set screen click 'Map Payroll Categories' and map your ETP Payroll categories to the relevant STP Fields.

Step 4

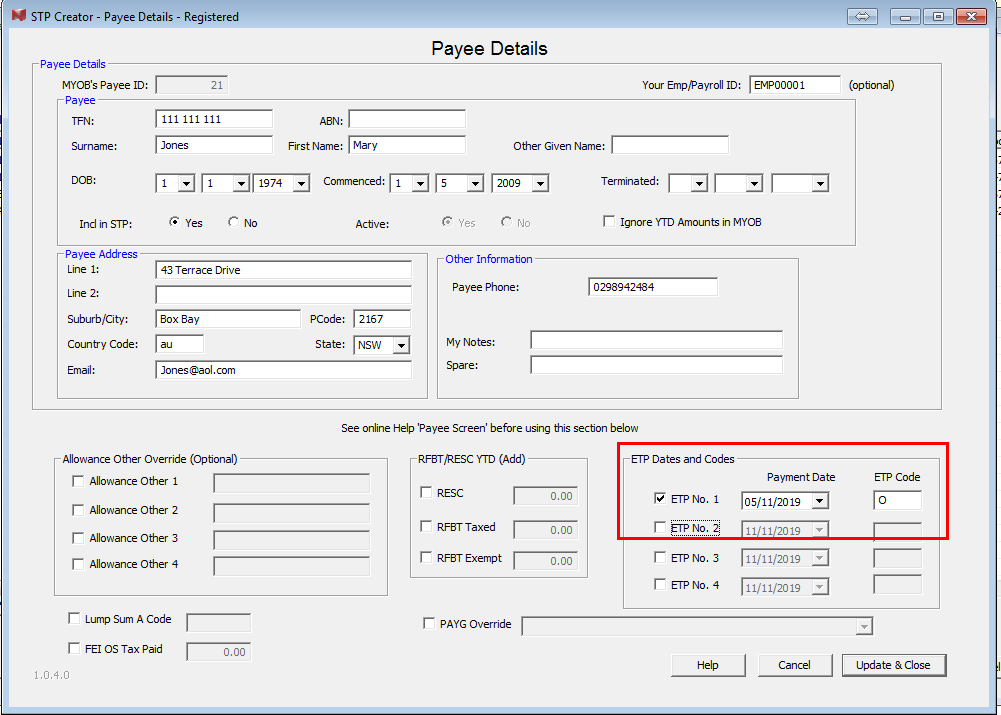

Enter the 'ETP Code' and 'ETP Payment Date' on the relevant employees Payee Details screen. From the Permanent Data Set screen click 'Select Payees'. Tick the Payee and then click Edit. Tick ETP1, select Payment Date and ETP Code (as per image below).

If unsure what code to use, consult your tax advisor. There are ATO links on our Add Payee screen - see under 'ETP Dates and Codes'.

Final Indicator

If this is the final payment for a Payee, don't forget to add a Termination Date and Final Indicator for this Payee - See Terminating a Payee for more information.