Finalise Payees before the End of Year

FROM:

SINGLE TOUCH PAYROLL ‘PAYROLL REPORTING’ BUSINESS IMPLEMENTATION GUIDE (SINGLE TOUCH PAYROLL BIG)

PAGE: 34

3.3 Finalisation — Declaration the employer has provided all information for an employee for the financial year

An employer is required to make a declaration to the ATO that they have provided all the information for each employee for a financial year. This is done by providing the finalisation indicator as a part of an employee’s STP report.

This declaration allows the ATO to make the employee information available for income tax return prefill for employees. It will also update the employee’s MyGov payroll page, to show the employee income statement for STP reported information is final for the financial year. Providing the declaration for STP reported information removes the employer obligation to provide their employees with payment summaries in relation to the STP reported information.

An employer may make the declaration at any time during the financial year, after the end of the financial year up to 14 July, or on the deferred due date.

To acknowledge STP transition for the 2018 financial year, the deferred due date will be 14 August 2018 and for the 2019 financial year the deferred due date will be 31 July 2019.

Final declaration

The declaration is made by an employer setting the final event indicator for each employee. Refer to section 5.

3.3.1 Finalisation during the financial year

1. The final event indicator is reported per employee, per payroll ID as a part of the employee record.

2. A final event indicator may be provided in a pay event or update event.

3. Where an employer reports the finalisation declaration during the financial year, this replaces the employer’s obligation to provide the employee with a part year payment summary.

4. Making this declaration will update the employee’s myGov display to show the STP information from the employer is final for the financial year. Pre-fill information will not be available until after 30 June.

5. Where the employer makes another payment to the employee in the financial year, this must be reported in a later pay event.

a. If it is a one-off payment, for example an ETP, and the employer does not expect to make any further payments or adjustments for the employee, the employer should make another final declaration for the employee in this report.

b. If the employer expects there will be further reports for the employee, for example, they have been re-hired; the employer should not mark these later reports as final.

c. Where the employer reports a later amount for an employee after they have made the declaration and this report does not include another declaration, the ATO will update the employee’s myGov display to show the later amounts as YTD and not final.

6. Where the payroll software apportions the gross payments in accordance with the days the employee worked for each ABN and the amounts withheld are allocated to the ABN making the payment or at the end of the pay period, the employer should report these amounts.

7. Where the final position for an employee for a financial year results in the total withholding being higher than the total gross payments, the employer will need to make an adjustment to ensure that the gross payments are allocated against the ABN that paid the withholding. This can be performed as part of the finalisation process.

Note: If an employer does not make this adjustment, the individual’s income tax return will not be prefilled with Income Statement data where withholding is greater than gross payments.

3.3.2 Finalisation after the end of the financial year

1. Employers must provide the final event indicator for all employees by the due date (14 July of the following year or deferred due date – 14 August 2018, 31 July 2019).

a. The employer should request an additional deferral of the due date from the ATO, if they cannot finalise by the due date.

b. If the employer does not provide the final event indicator by the due date they must provide a payment summary to their employees.

Compliance note: where these payment summaries are not provided by 14 July the employer may be subject to a penalty.

c. Where the employer has had to provide payment summaries to their employees as they have not made the final declaration by the due date, then the employer can provide the payment summary information to the ATO by finalising through the update event. Where the employer does this they will have met their obligation to provide a payment summary annual report (PSAR/Empdupe file) to the ATO.

2. Where the final event indicator is provided after the EOFY, it must be provided through an update event.

See also here for ATO's End-of-year finalisation through Single Touch Payroll.

How to Finalise a Payee in STP Creator

There are a number of scenarios for finalising a Payee - for example:

- You are reporting a Pay event for a number of Payees, with one or more receiving their final payment for the year.

- You are reporting your final Pay event for the payroll year for all Payees.

- You want to finalise one or more payees after you have already reporting their final payment.

- You want to finalise all Payees after you have already reporting their final payment for the year.

In the first 2 scenarios, you simply add a Final Indicator for the relevant Payees.

In the 3rd and 4th scenarios, you add both a Final Indicator for the relevant Payees, and you indicate this is an Update event (no new payments are being reported)

Scenarios 1 and 2

You can Finalise a Payee (or all Payees) while reporting a Pay Event, such as the last payroll transaction for the payroll year. Ensure all the Income Statement YTD figures are correct and tie in with MYOB® Payroll Register Summary YTD Reports.

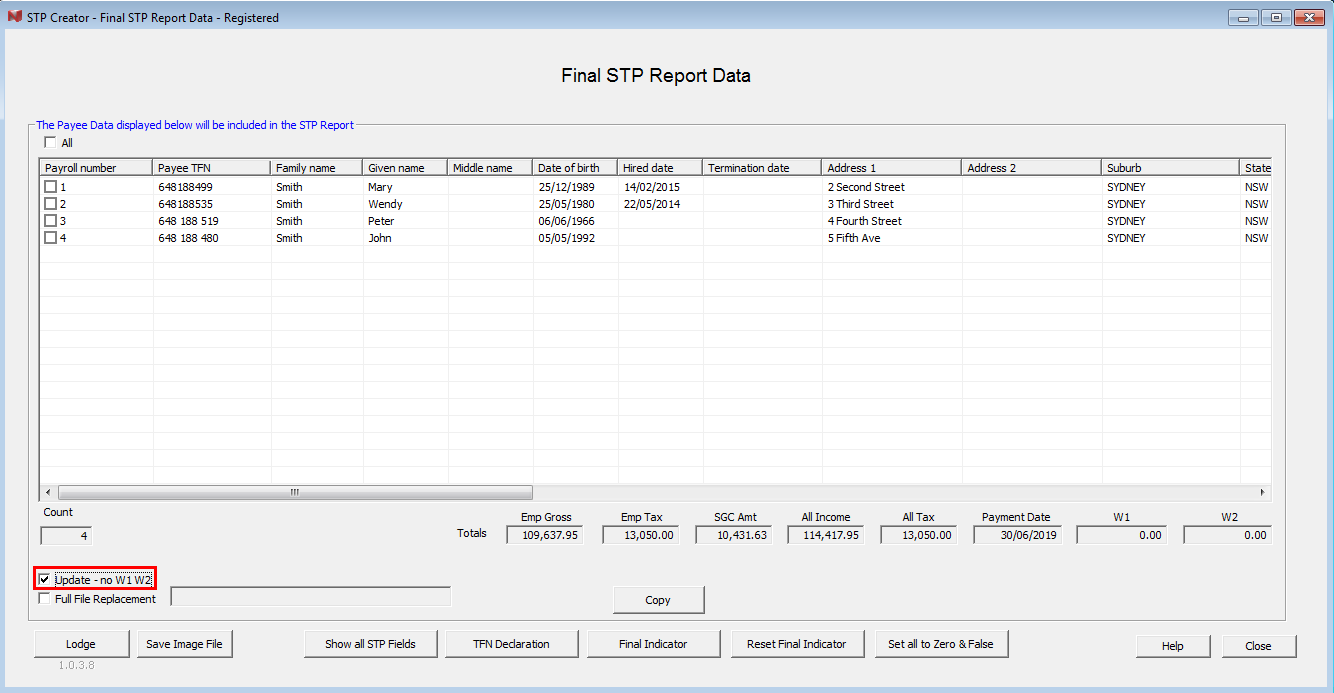

On the Final STP Report Data screen, select the Payee(s) you want to finalise, and click this button highlighted below. The value in the Final Indicator column will be changed to 'TRUE" for the Payee(s)

Lodge, Sign In and Send as per normal.

Scenarios 3 and 4

Ensure all the Income Statement YTD figures are correct and tie in with MYOB® Payroll Register Summary YTD Reports.

On the Final STP Report Data screen, select the Payee(s) you want to finalise, and click the Final Indicator button. The value in the Final Indicator column will be changed to 'TRUE" for the Payee(s)

Next tick the Update Checkbox as highlighted in the image below (unless it is already ticked).

Lodge, Sign In and Send as per normal.

Extra Assistance Required

As with any STP Creator issues, if you are having difficulty resolving, send us an email with the details (including screenshots). We will provide guidance via email as soon as we can. Alternatively if you would like someone to connect remotely to resolve the issue, we have a HelpMe! service - see link under Extras on our Purchase Page here - a fee applies.