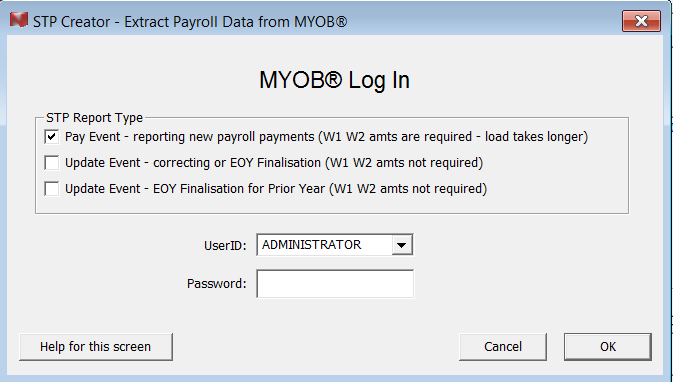

Extract Payroll Data from MYOB®

In order to speed up the process of loading data from a linked MYOB® company file, before reading the MYOB® company file, you may see this screen:

STP Report Type

Single Touch Payroll classifies every STP Report as either a Pay Event or an Update Event.

Pay Event

The default is a Pay Event which is when you are reporting a new payroll transaction (once a week or fortnight etc). When Pay Event is ticked, this tells STP Creator to extract all the the Employee YTD payroll amounts as well as the Payroll Transactions. The Payroll Transactions are used to calculate the Activity Statement W1 W2 amounts which are required for a Pay Event.

Update Event - current Payroll Year

An Update Event is used to correct Employee YTD details or to do End of Year Finalisation. Activity Statement W1 W2 amounts which are not required for an Update Event so STP Creator will not load Payroll Transactions, only Employee YTD amounts. This makes the load process much quicker.

Update Event - prior Payroll Year

If you have already commenced processing payroll in the new Payroll Year and have not yet done End Of Year Finalisation for the previous Payroll Year, use this option. STP Creator will load Employee YTD details for the current Payroll Year (as set in this MYOB® company file), as well as Employee YTD amounts for the previous Payroll Year.

Once the data has been loaded, you will be prompted to select which Payroll Year to use:

Select the Payroll Year and proceed with the End of Year Finalisation process. See End of Year Procedure for details.